Gifts That Cost You Nothing Now

Gifts in a will or by beneficiary designation are two easy ways to ensure that our serious and balanced news programs remain the most trusted news source for Americans for years to come — and they don’t cost anything now.

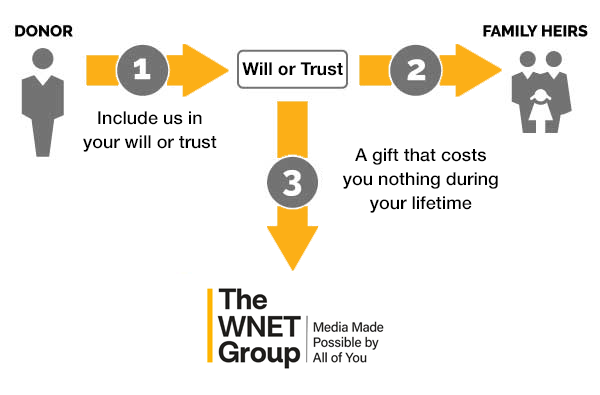

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for WNET. By simply signing your name, you can create a legacy of inspiring, thought-provoking and trusted programming.

Once you have provided for your loved ones, we hope you will consider making impactful public media part of your life story through a legacy gift.

A gift in your will or trust is one of the easiest ways to create your legacy and offers the following benefits:

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create your legacy of guaranteeing a bright future for all.

Three simple, “no-cost-now” ways to give in your will

Residual gift

Leaves all or a percentage of what is left over after all other debts, taxes, and other expenses have been paid.

Specific gift

Contingent gift

Leaves a stated amount or share only if a spouse, family member or other heir/beneficiary does not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

You can mix these no-cost ways together. For example, you might consider leaving a specific bequest to WNET along with a percentage of your residual estate, contingent upon the survival of a spouse.

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, life insurance, and more to use in providing lifelong learning and meaningful experiences — and it costs you nothing now.

By naming WNET as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of bringing arts and culture, news and public affairs, science and natural history, documentaries, and children’s programming to millions of viewers each week.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid costs and delay of probate

No cost to you now to give

Create your legacy with WNET

To name WNET as a beneficiary of an asset, contact the custodian of that asset to see whether a change of beneficiary form must be completed.

How to change a beneficiary designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: WNET

Include our tax identification number: 26-2810489

Save or submit your information online or return your Change of Beneficiary Form.

Types of beneficiary designation gifts

Retirement funds

You can simply name WNET as a beneficiary of your retirement plan to help us continue to tell authentic stories from diverse perspectives.

Life insurance policies

Bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name WNET (Tax ID: 26-2810489) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward providing free, trustworthy reporting on all platforms and creating innovative models that help all PBS stations better serve their audiences for generations to come.

Donor-Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name WNET as a “successor” of your account or a portion of your account value, you enable thought-provoking and insightful programming.

Our Team is Here to Help!

Our experienced team is here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up to date on how your gift is used.

- And more!